capital gains tax rate uk

Posted a day ago by Phoebe Lau. A 10 tax rate on your entire capital gain if your total annual income is less than 50270.

Capital Gains Tax Rate Should Double Says Government Review Bbc News

Business assets you may need to.

. If your taxable income is Higher Rate or Additional Rate bands you will pay 28 on any capital gains made on the sale of resident property. The capital gains flat rate for non-residents in Spain is a rate of 19 percent charged on the profits gained from the auction of a home. This is the amount of gains you can.

If you make a gain after selling a property youll pay 18 capital gains tax CGT. 2022 capital gains tax rates. In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax basic rate band.

The result of this is that the New Zealand resident beneficiaries are subject to Australian tax at non-resident tax rates between 325 and 45 on capital gains derived from New Zealand. I come from HK and have been residing in UK since end of Aug 2021. Income Bracket ProfitsCapital Gains.

250000 150000 100000 profit. UK Capital Gains tax rate in 2022. Capital gains tax applies when your land sale is more than your yearly exemption.

Tax if you live abroad and sell your UK home. 18 and 28 tax rates for individuals. The amount you pay varies depending on a variety of factors including your income and size of gain.

However the capital gains tax rate on shares are 10 for basic rate. Tax when you sell your home. Capital gains tax rates for 2022-23 and 2021-22.

There is one further significant difference between. Tax when you sell property. The amount of tax you need to pay depends on the amount of profit you make when you sell shares.

Tax rates change over time but the current 2022 Capital Gains rates in the UK are as follows. 10 and 20 tax rates for individuals not including residential property and carried interest. Work out tax relief when you sell your home.

If there was realized loss in 2020-2021 can it be used. You pay no CGT on the first 12300 that you. Capital gains tax rates for 2022-23 and 2021-22.

Tell HMRC about Capital Gains Tax on UK. Currently the capital gains tax for such individuals is. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Capital Gains Tax CGT usually applies to taxpayers who live in the UK but special rules bring expats and other non-residents into the tax net if they make a profit. Do you pay tax when you sell land UK. Refer to the HMRC website to find out the CGT allowances for previous tax years.

The capital gains tax rate on shares is 10 for basic rate taxpayers and. You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance called the Annual Exempt Amount. You sell a buy-to-let flat for 250000 which you originally bought for 150000.

What you pay it on. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. A capital gain tax is levied on gains on residential property if the sale.

Although the calculation more seems easy it is more. What is the Capital Gains Tax rate 2021 UK. The CGT allowance for the 202122 and 202021 tax years is 12300.

May 18 2020. The Capital Gains tax-free allowance is. Capital Gain Tax.

100000 12300 allowance 87700 taxable gain. 2021 capital gains tax calculator. Taxes on capital gains for the 20212022 tax year are as follows.

Capital Gains Tax rates in the UK for 202223. Capital gains tax rates on property UK are 18 for basic rate taxpayers and 28 for high rate taxpayers. The following Capital Gains Tax rates apply.

Your entire capital gain will be. Capital gains tax CGT breakdown. You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of all or part of a business asset.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

Uk Residential Property New Capital Gains Tax Rules Lexology

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Tax Rates Hub 2022 23 Accsys Accountants Kent Chartered Accountancy Practice

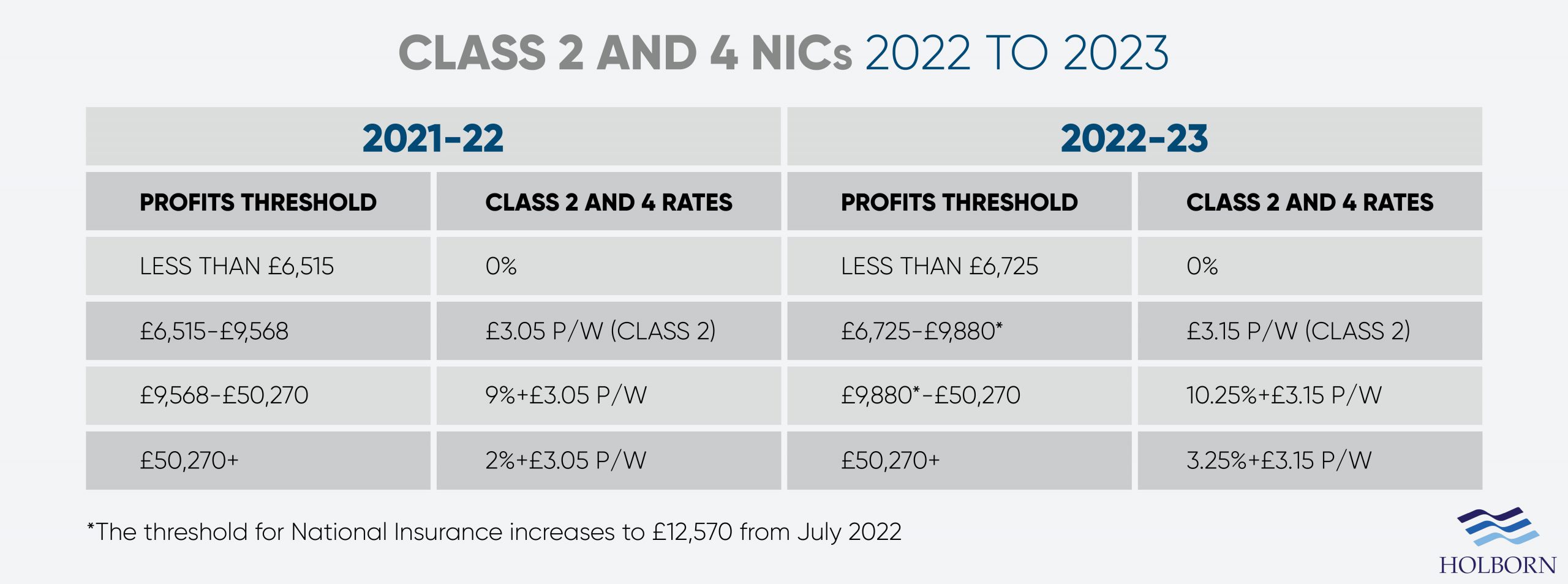

Changes To Uk Tax In 2022 Holborn Assets

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

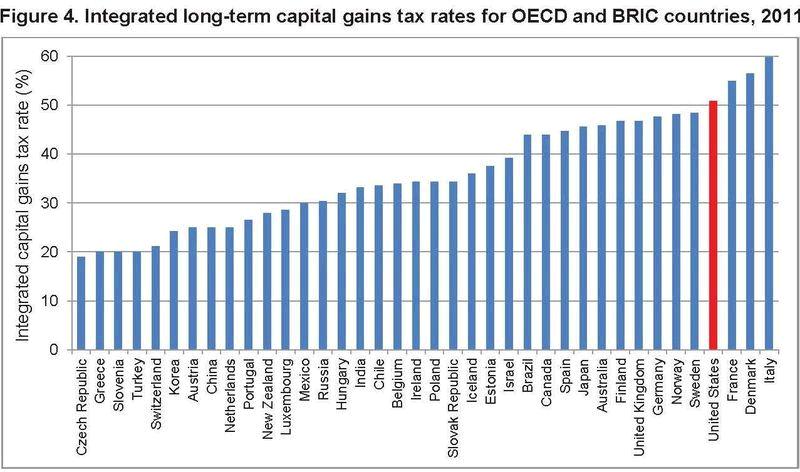

International Capital Gains Tax Rate Comparison Where Does The Us Stand Topforeignstocks Com

Capital Gains Tax Low Incomes Tax Reform Group

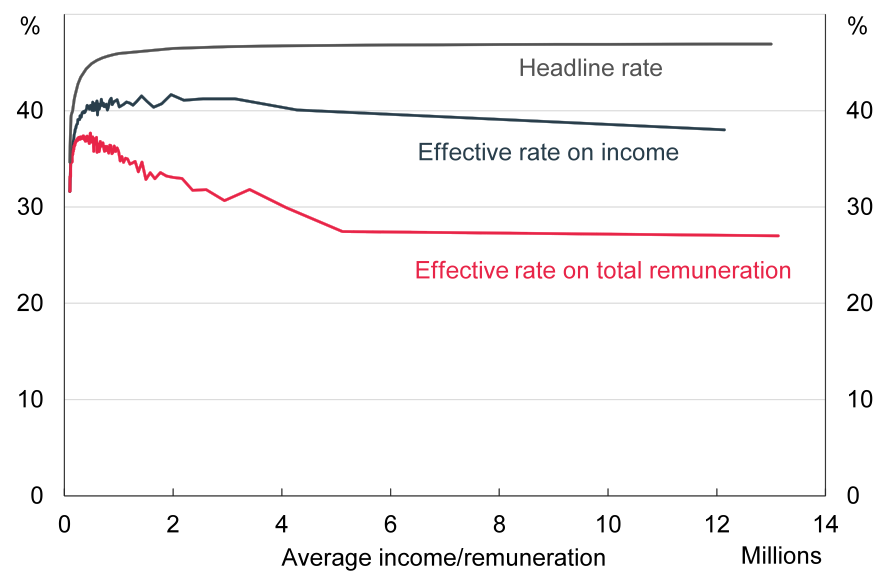

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Capital Gains Tax Returns Sa108 Timetotrade

Capital Gains Yield Cgy Formula Calculation Example And Guide

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

2021 Capital Gains Tax Rates In Europe Tax Foundation

U S Taxpayers Face The 6th Highest Top Marginal Capital Gains Tax Rate In The Oecd Tax Foundation

5 Potential Tax Changes That Could Help Pay The Coronavirus Debt

Capital Gains Tax Commentary Gov Uk

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany